In the wild world of crypto and prediction markets, where fortunes are made and lost on the whims of data and speculation, one trader decided to shake things up by letting their cat call the shots. Literally. PixOnChain, a trend spotter and Polymarket enthusiast, ran a hilarious experiment: using snacks to guide their feline friend in picking "Yes" or "No" on earnings prediction markets. The result? A modest profit that outperformed a simple coin flip—and arguably some human traders too.

The Setup: Snacks Over Spreadsheets

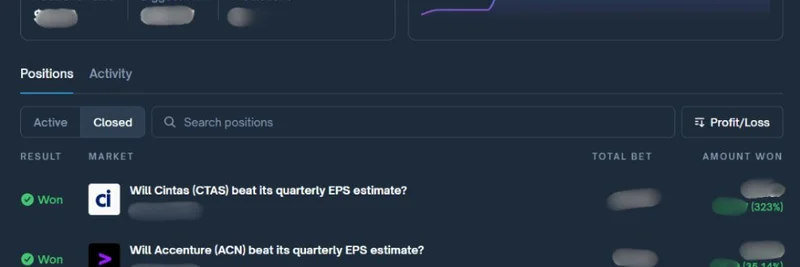

Polymarket is a blockchain-based platform where users bet on real-world events, from elections to stock earnings, using cryptocurrency. It's like a decentralized casino for the informed (or the lucky). In this case, PixOnChain focused on binary earnings markets—simple yes/no bets on whether companies like Cintas or Accenture would beat their quarterly EPS (earnings per share) estimates.

The rules were straightforward: over seven days, the cat chose between "Yes" and "No" cards by eating the snack behind one. No financial analysis, no charts—just pure instinct (or hunger). PixOnChain spread $100 evenly across eight markets, holding positions until resolution.

The cat, dubbed QuantCat, had no resume: no CNBC binge-watching, no knowledge of market gurus. Yet, she picked six "Yes" and two "No" bets. Skeptical? So was the experimenter at first.

The Rollercoaster Ride: From Losses to Wins

Day one started rough, with the portfolio dipping 4%. By day two, it was down nearly 10%. But then the magic happened. Cintas flopped its earnings, pumping the "No" bet by 323%. Accenture followed with a 35% gain, Micron at 14%, and MillerKnoll at 33%.

Not all were winners—four positions (Costco, Concentrix, CarMax, Jabil) tanked to zero. Still, the overall unrealized profit-loss (uPnL) hit +14% mid-week. By the end, the experiment yielded a 0.98% return, translating to an annualized percentage rate (APR) of 51%. Not retirement money, but better than many traders that week.

Why This Matters in the Meme Token World

This story isn't just catnip for laughs; it highlights the meme-worthy chaos in crypto. Meme tokens like Dogecoin or PEPE thrive on virality and randomness, much like QuantCat's snack picks. Prediction markets add a layer of blockchain utility, where decentralized betting meets real-world outcomes. It's a reminder that in crypto, sometimes luck (or a hungry pet) beats over-analysis.

Polymarket itself is gaining traction in the blockchain space, especially with its integration into crypto ecosystems. For meme enthusiasts, this experiment underscores how fun narratives can drive engagement and even small wins.

What's Next for QuantCat?

PixOnChain shared the full thread on X (formerly Twitter), complete with screenshots and a link to QuantCat's Polymarket profile. They're polling followers on scaling up: $1,000 over a month. If the comments are any indication, the crypto community is all in for more feline forecasting.

In a space dominated by algorithms and AI, it's refreshing to see a low-tech approach steal the show. Whether you're a seasoned trader or a meme token holder, stories like this keep the blockchain world entertaining. Who knows—maybe your pet could be the next big quant.

For more insights on meme tokens and crypto quirks, stick around at Meme Insider. And check out the original thread for all the details.